Hustle Dreams: how hustling let one ‘Shujaaz’ hero take control

- Money & Entrepreneurship

- Skills & Education

- 11 Nov 2019

We caught up with Kevin ‘Kevo’ Waweru, 22, in his hometown Embu last year, to hear about how starting a ‘hustle’ allowed him to take control of his finances, and then his future.

Kevin was brought up by his grandmother, after his parents died in a car crash when he was five years old. Kevin told us that his grandmother sacrificed a lot to support him through school and to help him complete his primary school exams.

In 2011, Kevin moved to Embu County, where he had to find ways to support himself. He took up a number of small jobs to help him pay for food and rent, and told us he sometimes had to engage in petty crime to make ends meet.

After a year in Embu, Kevin managed to save enough to fund the first term of high school. But he ran out of cash for the second term – and had to skip classes to make more money.

That’s when Kevin set up his ‘hustle’ [an informal micro-business] selling hard boiled eggs and kachumbari around Embu, with his friend Nyambe. By selling eggs to commuters after school in the evenings, Kevin managed to stay in school – even if he did have to miss some classes to focus on hustling.

But things changed for Kevin when Nyambe was arrested and jailed for 7 years, for stealing phones one day at the market.

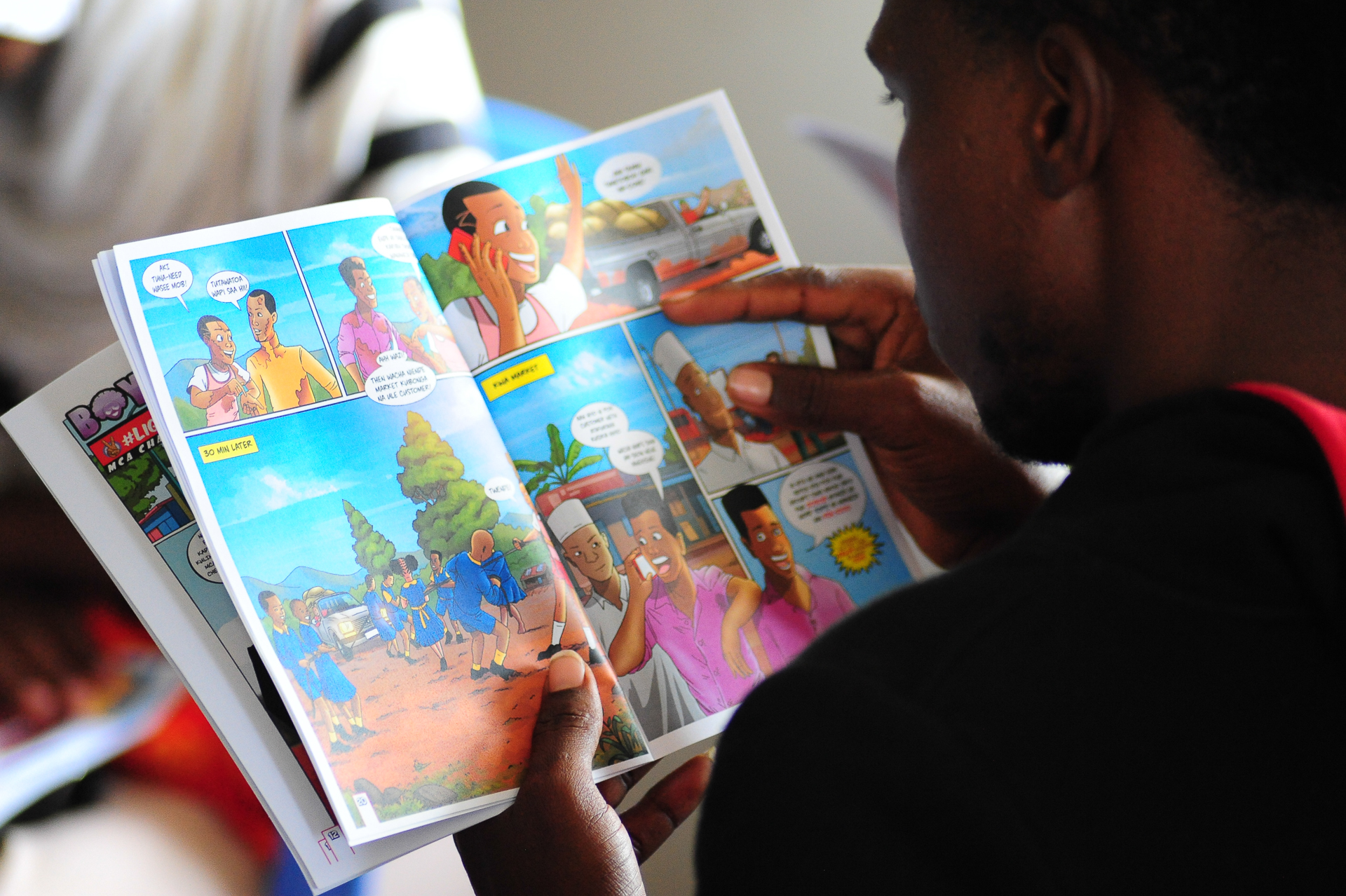

He decided to make a change. Because something else had happened whilst Kevin was at high-school; he had discovered the Shujaaz comic books.

A young person is like a car, they need fuel to get them moving forward. Shujaaz is like that fuel.

The monthly Shujaaz comic book provided Kevin with a place to learn useful, relevant information about how to grow his hustle –– and crucially, gave him the impetus to start saving.

‘I remember Charlie Pele [a Shujaaz character] advising his brother Taabu to save money for his wedding, instead of asking his parents for it. This advice really hit home.’ Like Charlie, Kevo began using a mobile money service to start saving, allowing him to put aside money regularly and keep it just out of his reach.

In his time out of school, Kevo focused on his hustle –– building a base of regular customers.

During this time, one of those customers asked him why he wasn’t in school. Kevin explained how he was struggling to support himself, without parents to help out. The customer offered Kevin work with him, as a night watchmen, in exchange for paying his school fees.

Like more and more young Kenyans who fend for themselves, Kevo realized that in order to survive, he had to have multiple sources of income, and multiple hustles. In this way, he was able to complete the last two years of high school uninterrupted.

Kevin kept saving through school, eventually saving enough to go to college. Kevo managed to attend a course in emergency response with a focus on fire fighting and is now working as an intern firefighter at the Embu County emergency response centre, earning $15 a month.

According to the latest national survey by Shujaaz Inc, only 4% of Kenyans aged 15–24 have an independent income that generates enough money to set aside so that they can survive a crisis. Kevin is among only 35% of young Kenyans who can be described as a ‘saver’ –– half of those, like Kevo, save for a particular goal, rather than as a habit.

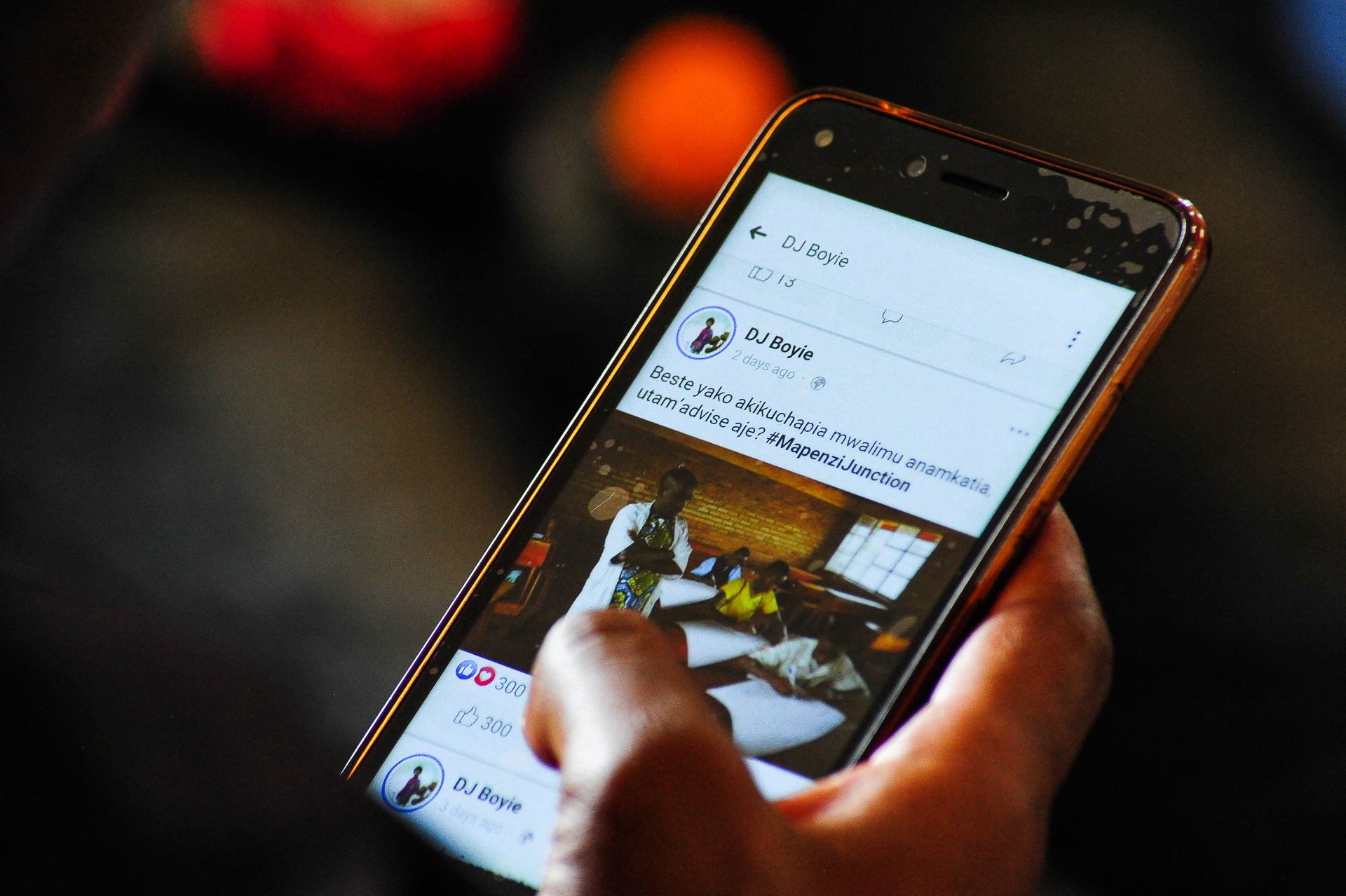

Digital Financial Services — chiefly mobile money services — represent a friendly and available way for many young Kenyans to manage their money. They are cheaper and more accessible when compared to traditional financial institutions, like banks.

Whilst 80% of Kenyans above the age of 15 have tried using some digital money method; most only use them for basic transactions rather than their savings or borrowing potential. Across our Shujaaz Inc ventures, we share stories like Kevin’s with our network of 7.5 million fans, to demonstrate the impact digital savings can have.

I’d describe Shujaaz as a catalyst’ Kevin told us, ‘it gives you tips on how to actualize your ideas. My goal is to become a Shujaaz [hero] and inspire other people to make wise decisions in their lives.

Kevo’s love for Shujaaz is well known among his friends and a number of them can point to its impact on their lives since he introduced them to the Shujaaz media. He will regularly take multiple copies of the comic to share with his friends. “I’m a Shujaaz Ambassador,” he says proudly. His fellow intern firefighter, also named Kevin, shares how he started a business with Kevin’s encouragement. “Kevo told me to start a hustle of my own instead of depending solely on money from my parents.” The kiosk shop he started now provides him with enough money for his daily expenses.

Judging by his track record, it’s only a matter of time before his dream of being a fire fighter comes true. ‘If my dreams come trye, I want to set up a place to empower young people, to become the next Shujaaz.’

Before we left, Kevin said ‘I don’t think of myself as a poor person. I’d actually say I’m creative, an innovator.’ That’s the mindset shift that hustling can spark; a shift that lets young people take control, seize opportunities and create a new future for themselves.

Over 1 million young people enter the Kenyan job market every year, but only 25% of them can expect a formal job. Jobless youth include college graduates, 50% of whom are unemployed. We know that the saving and Hustling skills Shujaaz fans like Kevin acquire as part of our network creates transformational change.

![Spotlight on youth and youth voices on the International Youth Day [ARCHIVE]](https://www.shujaazinc.com/wp-content/uploads/2019/12/BKM_0716-321x242.jpg)

![#Shujaaz360 KENYA 2017 State of the Youth Report: Part 1 ‘The Money Squeeze’ [ARCHIVE]](https://www.shujaazinc.com/wp-content/uploads/2020/01/NEWinfo_money-1.jpeg)